Listen to me interview Betterment in my podcast.

Listen to part 2 of my interview with Betterment!

SIX MONTHS FREE – WITH NO FEES

Click HERE to get this special offer.

During the past 8 years the investment market has seen some fantastic highs and some dramatic lows. Knowing what, where, and how much to invest today is difficult to sort out on your own. The fear of making an investment mistake can keep you from investing altogether because you don't know where to start or what to do. In the meantime, instead of your money growing and working for you, you're treading water financially, at best.

If you want to build wealth, save time, save money, and lower taxes, I've become a huge fan of the investment service Betterment. Betterment is an SEC Registered Investment Advisor, and Betterment Securities is a broker-dealer regulated by FINRA and the SEC. The securities in your account are protected up to $500,000 by SIPC.

You don't need to be a financial wizard to use a service like Betterment, they do the hard work for you.

My bottom-line: Although Betterment is among the highest rated services for investors at ALL investment levels, I'm personally convinced that for anyone just starting out or investing less than 100k, Betterment is the best investment solution I know of. It's super easy and you can get started with NO minimum investment!

Unlike a lot of other complicated investment tools, there is no minimum investment amount, no minimum balances to maintain, quick and easy account setup, and your deposits can be automatic. This is a HUGE benefit if you'd like to take your monthly grocery savings and start investing for your child's college education, retirement, or any other goal you have.

Want to get started with a investment account with just $40 a month? No problem. Betterment is for you. Even if you set up Betterment as a separate retirement/college savings account in addition to your employer's 401K plan, you'll likely come to the same conclusion that Betterment's existing customers have come to: it's smart, simple, and effective – and a great fit to a consumer savings plan like what I teach through SavingsAngel.

SavingsAngel can help you save money. Betterment will allow you to invest in yourself and your family's future. It's a great fit!

I've sat in those confusing meetings with my family's financial planner. I've reviewed my financial planner's fees. I've been incredibly frustrated by the old style of trying to move forward with savings and investments. If your situation is like mine and you'd like something simple, automatic, dependable, mobile-friendly, and popular, Betterment is always at the top of favorite investment services for most people.

Another difference between Betterment and many other investment advisors and/or services is that they are able to maintain lower fees through the use of ETF's (exchange-traded funds) which carry low expense ratios. Lower fees mean that more of your hard earned dollar is going to work for you. Don't get me started on how much my wife and I paid our last financial advisor.

What does Betterment charge? Betterment charges a prorated management fee of 0.15% to 0.35%, depending on your balance and automatic deposit. If you don't autodeposit, there is an additional flat $3 fee per deposit – but these rates are extremely competitive. Fees are charged at the end of each calendar quarter (every three months). Plus, the more you invest with Betterment, the lower the fees.

What does Betterment charge? Betterment charges a prorated management fee of 0.15% to 0.35%, depending on your balance and automatic deposit. If you don't autodeposit, there is an additional flat $3 fee per deposit – but these rates are extremely competitive. Fees are charged at the end of each calendar quarter (every three months). Plus, the more you invest with Betterment, the lower the fees.

Where is my money being invested? With Betterment your money is invested in a globally diversified portfolio (with over 5,000 companies) of low-cost and liquid ETFs selected for the best returns possible within your chosen level of risk.

What can Betterment do for me? Their goal is to maximize your return with minimal risk. No matter what your financial goal, Betterment can help you with:

Investment Growth ““ You can start anywhere from a short-term Safety Net (emergency fund) to a long-term Retirement Fund to an even longer-term Wealth Building goal.

Retirement – Every stage of retirement planning, growth, preservation of wealth, retirement income, and 401(k) consolidation are available.

IRAs – Betterment provides a dedicated rollover concierge to each customer rolling over 401(k), Roth IRA, or traditional IRA retirement assets.

Trusts – Setting up a trust with Betterment is quick and can be done entirely online. And, you have the capability to create multiple goals tailored to each beneficiary.

Tax Loss Harvesting ““ Tax loss harvesting is selling a security that has experienced a loss””and then buying a similar asset to replace it. The switch does two things: it allows the investor to realize, or “harvest”, a valuable loss while keeping the portfolio balanced at the desired allocation.

What happens if I've put money into my investment account and I need access to those funds? Life happens – and you shouldn't be penalized for accessing YOUR money. There are no fees for transactions with Betterment – ever. Again… this is a sore subject for me – based on a bad experience in the past. Speaking as your consumer advocate friend, please save yourself some pain, and take a peek at how Betterment could work for a long-term savings and investing plan for you and your family.

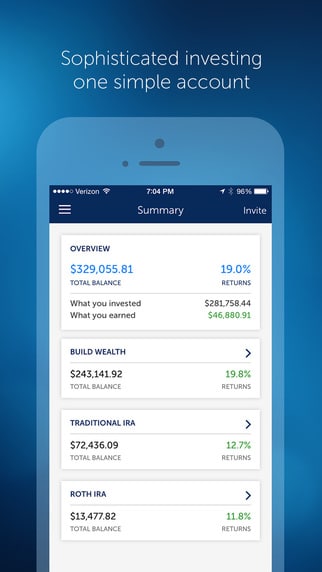

Like mobile apps? Yeah. So do I. Betterment's apps are attractive, easy to use, secure, and provide access to your investments in a way that you'll likely love. In the iOS app store, their app has garnered 443 reviews – maintaining a 4.5 star average. In short, people love Betterment.

If you're looking for a way to save that is going to pay you beyond the meager amounts you get from a traditional savings account, CD's, and the like, Betterment may be the better investment for you!

How to get a better deal than just going directly to Betterment's website to sign up for an account? I've asked what their best special offer is – and here it is: