Student Loan Crisis: How to get cash and avoid loans

Student Loan Crisis: How to get cash and avoid loans

America's Money Answers Man, Jordan Goodman, author of the book The Ultimate Guide to Student Loans, is drawing attention to the crisis in the student loan industry. Knowing how to get cash and avoid loans is more critical than ever.

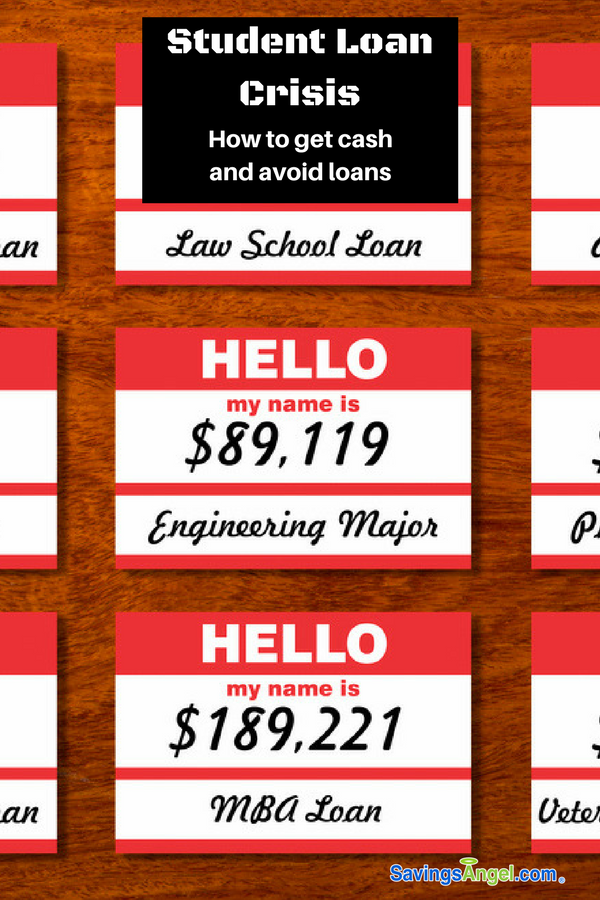

Consider these stats:

The average undergraduate leaves with $38,000-$50,000 in student loan debt. Graduate school piles on another $200,000-$300,000 per student, and specialty occupations, like dentistry, can accumulate even more – around $400,000! Currently, 20% of the $1.3 trillion in student loans are in delinquency or in default status, only making it even harder to pay them off. Once delinquency and default are reached, loan interest rates skyrocket, they garnish your wages, and they will even take any extra money you may come into, such as a tax refund you had coming.

These staggering amounts are financially crushing young adults like never before, newly creating what Goodman calls the “boomerang generation”, which is when young people end up moving back in with their parents. Goodman adds that over 50% of young people are having to move back in with their parents because repayment of their student loans eat up so much of their income they simply cannot sustain being out on their own.

So how do you avoid being a statistic?

(1) Look into what your state offers for free. Some states like New York and Tennessee are now offering free college if you meet certain eligibility.

(2) Apply for any and every scholarship and grant you possibly can. Check into local civic groups, churches, unions, and other organizations, as well as local, state, and federal government offers and grants. Don't simply assume you'll never land one. Not all scholarships are based on grades or athletics. There are scholarships that weigh things like community involvement or skills in arts and sciences much more heavily than academics. Check with leaders and organizations that revolve around your interests. And don’t overlook scholarships for the years after your first year. Save thousands by making a list and applying as soon as application windows open up.

(3) Work, work and work some more. The “worked my way through college” way is definitely hard but achievable. It may cause college to take a little longer but that's better than paying off loans for years and years to come. Choose a manageable class schedule so you can work and pay for things as you go. Either continue an existing job or get into the school's work-study program.

Alternatively, if you excel in any area, consider a paid tutoring job. Some colleges offer tutoring programs and hire students or you can start your own small tutoring service. By working, not only will you not accumulate debt, you'll gain invaluable work experience. You can show potential employers both a diploma and years of experience – squarely placing your resume on the top of the heap.

(4) Get the absolute best price you can on books and other necessities. Do the necessary research now to determine where you can obtain books, supplies and things like lab needs at the lowest possible price. Spend as little as you can so you avoid accumulating additional debt on a credit card.

(5) Use the college's available guidance and career service. Take time to meet with a counselor to ensure you're only taking classes that you really need. You can save thousands – and a lot of time – by avoiding classes that are unnecessary or won’t transfer if needed later. Undeclared students, especially, should focus only on the basics needed for all career paths and make certain any acquired credits will transfer.

(6) Go local. It may not be palatable at first thought when you're eager to get out on your own but you can save thousands by going local the first year or even two for basic classes. Credits from an accredited community college usually transfer well but are much less expensive, and still living at home saves thousands.

If you already have crushing student loans, here are three things you can do about them:

– Consolidate your loans into one manageable payment.

– Refinance your loans at a lower interest rate.

– Qualify for the IBR program (income-based repayment program), which requires that you work in a government or non-profit organization for a minimum of 10 years, during which you pay the minimum repayment amount consistently, and after which any remainder is forgiven.

Time for a break.