Listen to Show 261 – How to Save Money on Auto Insurance – Need some extra cash? Consider a side hustle – Not Everything In a Sales Flyer Is On Sale – A BIG SavingsAngel Thank You!

For a better listening experience, listen in Apple Podcasts or Stitcher.

This podcast post may contain affiliate links or links to sponsors of the SavingsAngel Show.

This podcast post may contain affiliate links or links to sponsors of the SavingsAngel Show.

Hi! I’m Josh Elledge, the Chief Executive Angel of SavingsAngel.com and welcome to the SavingsAngel show! I’m podcasting to you here, in Orlando, Florida.

I am an extremely busy consumer expert, money-saving advocate, syndicated newspaper columnist, and the guy that turns digital entrepreneurs into media celebrities with UpMyInfluence.com. I love what I do and can’t wait to get going on today’s episode.

In order to help you save more, earn more and live more abundantly on today’s show I’ll be covering:

- How to Save Money on Auto Insurance

- Need some extra cash? Consider a side hustle

- Not Everything In a Sales Flyer Is On Sale

- A BIG SavingsAngel Thank You!

SHOW NOTES

How to Save Money on Auto Insurance

As if owning a car isn’t already expensive enough, you also have to have auto insurance. It’s the law! Rates can vary dramatically from one state to another, and from one driver to another. But there are ways to save money on auto insurance, and they’re even more important if you’re in a high-cost policy.

Try a couple of the strategies below and see how you can save money on auto insurance.

Shop Around for a Policy

This may be the single best way to save money on auto insurance. There’s a big difference in premium rates between auto insurers. That happens because one company may be looking to reduce their exposure in your state – and charge higher rates – while another is looking to expand their business in your state, and charges lower rates.

Be sure to go with a company that offers the lowest premiums for identical coverage. Be very careful that the company that charges less isn’t cutting out some important coverage types. For example, a company that’s providing lower dollar amounts of coverage will usually have lower premiums. But that will leave you more exposed in the event of an accident that’s your fault.

Shop for a New Policy Every Year or Two

The top auto insurance companies are aware that people don’t like shopping for coverage. For that reason, they’ll increase your premium with the expectation that you won’t leave. Companies also increase premiums because they may have a substantial increase in the number of claims paid in your state.

The point is, you should plan to shop for a new policy every year or two. Though the company you’re with now may have been the cheapest when you got the policy, there may be other companies offering an even lower price on similar policies now. You owe it to yourself to at least investigate the options.

Increase Your Deductible

Deductibles are most typically set at $500 because it’s a manageable amount in the event of a claim. By increasing your deductible to $1,000 or more, you can shave a good bit off your premium.

But it’s important to realize that by increasing your deductible you’re also increasing your exposure if you’re in an at-fault accident. But you can lower that risk by making sure you have an amount in a savings account that will cover the deductible if that happens. In that way, you’ll save money on your premium, without putting yourself in a financial hole if you have to come up with a higher deductible.

Ask About Discounts

Auto insurance policies have all kinds of discounts that will lower your premium. But not all insurance companies will tell you about all the discounts that are available. That’s why you need to ask, and even see if there’s a webpage on the company site that lists all the available discounts.

Examples include discounts for:

- Low mileage

- Good student

- Multiple drivers or vehicles on the same policy

- Safety equipment on your vehicle

- Good driver (accident-free for at least three to five years)

- Homeowner

- Affiliation with certain organizations or employers

That’s just a short list, since each company has its own discount offers. Be sure you aren’t overlooking any.

Maintain a Good Driving Record

If you haven’t had any accidents or moving violations within the past three years, you’ve already got this one in the bag. But if you do, there’s still something you can do to improve your record.

Many auto insurance companies will charge a lower premium for drivers with violations or accidents if they complete a safe driver course.

While that may sound like a perfect solution, it isn’t always (but it’s always worth a try!). Before signing up for a safe driver course, make sure it’s one approved by the insurance company. If not, they won’t recognize it. Also be sure that the cost of the course (yes, you will pay for it) won’t be higher than the amount you’re going to save on your premium.

And if all else fails, be especially careful to maintain a good driving record for at least three years. At that point, you’ll get the benefit of the good driving record on your premium, without having to do anything extra.

Bundle Your Auto Policy with Other Insurance Policies

Insurance companies will often provide a discount of as much as 10% or 15% on your auto insurance if you bundle it with other types of coverage. This can include life insurance and especially renter’s or homeowners insurance.

However, this strategy is not without disadvantages. First, it will force you to change an existing life insurance or homeowner’s or renter’s policy for a new one. Second, while you may save money on the auto insurance, you may pay more for the bundled policy. And third, it causes a complication when the day comes – and it will – that you want to change your auto insurance policy. When that day comes, you may need to change two or three policies. And that can get complicated.

But it’s at least equally possible none of those negative scenarios will play out, and you’ll save money on the bundle.

By using any one or several of these strategies, you can save money on auto insurance, and no small amount at that.

***

Need some extra cash? Consider revamping your Career

Whether you want a new career or just some extra cash, U.S. Career Institute has a program for you. For over 35 years they’ve helped people prepare for legitimate work-at-home job opportunities in the growing healthcare industry – like Medical Coding & Billing. You would be your own boss and choose your own hours! And, you can learn how to do it online, in as little as 4 months. Study at home, or anywhere, at your own pace – anytime day or night. Imagine the freedom!

U.S. Career Institute is accredited by the D.E.A.C, offers affordable tuition, and they have an A plus rating with the B.B.B! Best of all, you can be ready to work in as little as 4 months, with no previous medical experience required.

Work anytime day or night, anywhere you want, with no monetary risk of business overhead, employees, or the demands of customers and sales goals. You can enjoy a secure and rewarding career in the growing healthcare industry all from the comfort of your own home!

Student testimonials show just how rewarding it can be to choose U.S. Career Institute to bring in extra money. One of their students, Judy, had been working part-time for the last few years. She had been bouncing around from this office to that, never really staying put long enough to grow roots.

She was always the first one laid-off off or the first to see her shifts cut. She got married right out of high school, had kids right away, and focused on raising her family. She never really intended on being a “professional” anything – except now that her kids were older, she really wanted a steady, satisfying job that brought in extra income; but one that still allowed her to put family first. She’s super-organized and smart but had no official work history or formal education.

Then she found US Career Institute, an online school that taught her Medical Coding & Billing. She studied at home on her own time, and even kept her day job while doing it. Now she works at home making great money in the healthcare industry – and she gets to set her own schedule! She can basically work anytime, anywhere. Can you imagine the freedom?

Get information on U.S Career Institute for free by visiting workfordoctors.com/ANGEL. Enroll with code ANGEL by Monday, October seventh to get 25 percent off tuition. Exclusions do apply.

For more details on this amazing limited time offer, visit their website for details at work-for-doctors-dot-com-slash-angel.

***

Not Everything In a Sales Flyer Is On Sale

Every week we look at our favorite store ads looking for their weekly sales. But sometimes we forget that just because it's in the weekly ad doesn't mean it's a deal.

How do we know? Look for terms such as ‘Great Low Price' which may indicate the store is simply advertising the regular price instead of offering a sale.

Another way for us to know for sure is to know your prices. And of course, use coupons. It's a surefire way to get a lower price on things you buy!

***

A BIG SavingsAngel Thank You!

I wanted to take a moment to thank all of you, our SavingsAngel listeners.

It is with great joy that I announce that the SavingsAngel Podcast landed in the top 50 Best Money Podcasts!

We couldn’t have done it without you, our devoted listeners. It’s been an absolute pleasure to serve all of you!

***

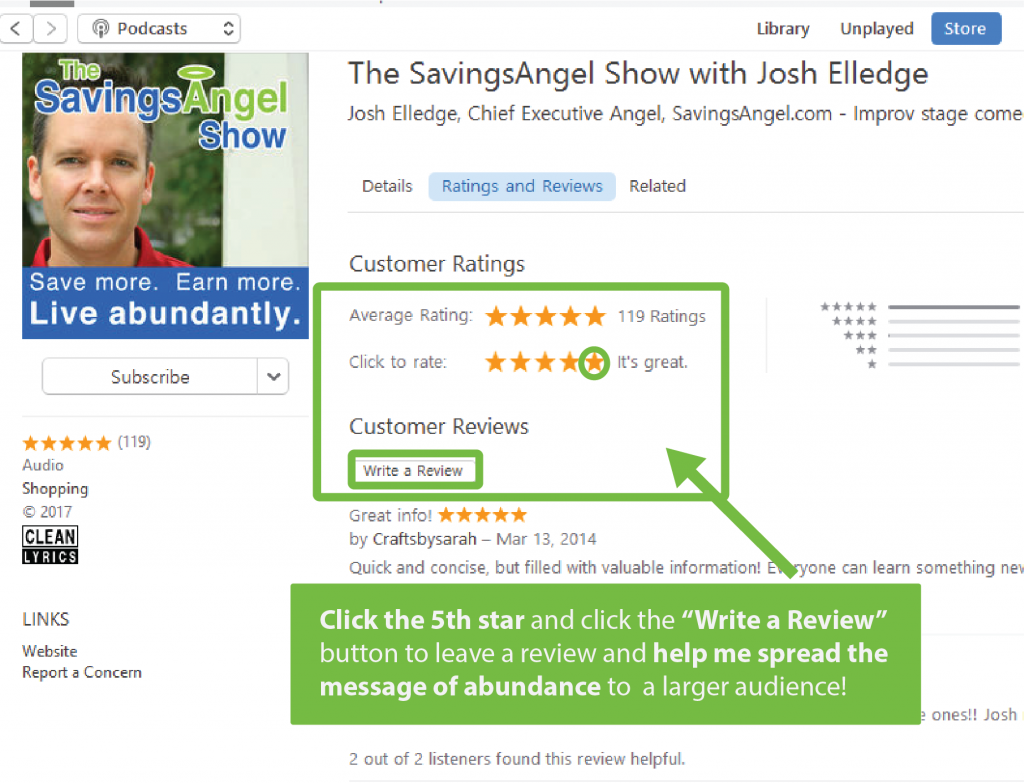

If you’ve loved hearing everything on this podcast, SHARE THIS episode with a friend! People NEED this information. You and I, together, can change lives. I recommend taking a screenshot and posting on FB – or wherever you hang out most.

And as always, if you have any specific questions, or if there is something you’d like to hear me talk about, you can drop me a comment in the podcast feedback, write me on my Facebook group, or call my podcast hotline at 407.205.9250 and leave me a message. I’ll answer your question, write you back, or – with your permission – I might even share your question or story with others on this show.

Have a wonderful week – full of saving more, earning more, and living more abundantly – and thank you for listening!

***

Links mentioned in this podcast:

https://www.goodfinancialcents.com/best-auto-insurance-companies/

https://www.goodfinancialcents.com/best-homeowners-insurance-companies/

https://savingsangel.com/the-latest-printable-coupons-2-2-2/

https://www.savingadvice.com/articles/2019/08/02/1067540_best-money-podcasts-part-2.html

workfordoctors.com/ANGEL for 25% off tuition

***

Call the podcast hotline with your question or comment: 407-205-9250

More places to keep your eye on!

SavingsAngel facebook group – lots of consumer hints, tips, and more! Join us.