YNAB Review 2016 – YouNeedaBudget.com

To say I’m impressed with YNAB would only be telling you half my feelings. I’m not only impressed with it, I’m invigorated by it! As someone that has tried multiple ways to maintain a budget for many years, I can honestly say that I’ve never come across a system that is this integrated and thorough, with portability that sets it above all other methods I’ve ever known. If you’ve been using a clunky, labor-intensive way to budget – or not even using a budget at all – you need YNAB – You need a budget.

Why all the fuss? What makes YNAB better?

In this YNAB review 2016, I’ll try to convey the properties that make YNAB so helpful, and why I highly recommend it.

Before I do that, let me preface this YNAB review 2016 with this: I am a money and saving nerd, but that doesn’t necessarily mean I’m good at being consistent with a written budget. And when I say consistent, I don’t mean making sure the bank accounts are balanced and I’m not overspending any account – I always do that – I’m talking about taking the time, every week, to categorize and record every dollar spent. As YNAB says, making sure every dollar has a job. That… well, I think it would be safe to say is more in spurts. I do well for a while, then life gets busy… a month, or 3 goes by… and then I get back to being more intentional again… I’m sure many of you can relate.

So ease of consistency is, by far, the first thing that hooked me with YNAB. Because being consistent with budgeting is my biggest area of struggle, as I believe it probably is for many, I was immediately excited and motivated by YNAB’s easy to use, portable interface. Knowing that I can input the money I have to spend, move things around if something comes up, and, best of all, check if I can spend before I do – no matter where I am – is a financial breakthrough for me personally. It’s better control over my money – and it’s what YNAB is all about.

The next thing that really encouraged and impressed me is YNAB’s extensive help section, every step of the way. It’s so good, that even though I’ve begun using YNAB, I still haven’t even seen everything they have to offer. You can read the user handbook, watch example videos on how to use YNAB, ask questions, read their blog, and even attend free classes. There is no reason to ever get bogged down and stop budgeting. You’ve got help available to answer any dilemma – or even just to understand how to use the app.

Now, before I go on, I must do my due diligence in this YNAB review 2016 and tell you that although YNAB is pretty slick, you still have to put in the work. Just like anything important in life, learning to use their budgeting app will take some concentration and a little effort. After all, you’re learning a new interface. Plus, YNAB is really good at reminding you about things you may otherwise overlook or forget to budget; which is another thing that sets them apart. So plan to invest some time learning, inputting your information, giving your dollars jobs, and definitely rearranging your priorities as you go along. YNAB is big on getting your priorities right, so you can win financially. If you need a push in that area, that’s just one more reason YouNeedaBudget (.com).

What exactly does YNAB do for me?

I could give you the simple answer in this YNAB review 2016 – which is that they empower you to prioritize and control your money better – and that would be true. But then this would be a very short, and not very informative review. So let’s talk nuts and bolts.

When you begin with YNAB, they give you steps to follow to set up your budget.

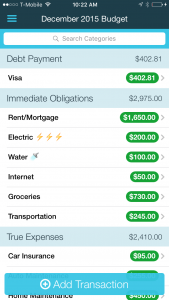

– You’ll adjust the overall categories of budgeting, which they keep very simple to start, but you have control to make them as in depth as you’d like. This is things like, “Immediate Obligations” or “Just for Fun”.

– You’ll add or remove specific spending categories within your overall categories, such as a mortgage or auto insurance. Don’t have child care expenses? Simply remove that spending category. Have something you don’t see listed? Add it.

– As you fix up the categories, you’ll assign a budget amount for each one, such as inputting the amount of your monthly rent.

After your budget is started…

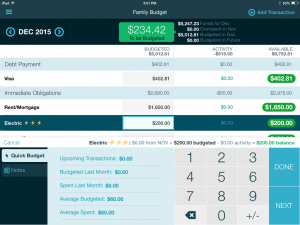

– You’ll securely link your bank accounts, credit cards, and other asset or liability accounts.

– As you spend, transactions are imported, giving you the same information you receive by logging into your bank online or reading a paper statement, but with a huge advantage. Each item is marked individually for you to categorize it into your budget.

– You’ll categorize your spent dollars. For example, you might have a $23 debit for eating out in your transactions, waiting to be categorized. When you select “dining out” in the dropdown menu of your personal budget categories, YNAB automatically plugs it in as an expenditure in that category. And your available funds in that category adjust automatically. That way, next time you want to eat out, you can see how much you have left for the month, and you can make a decision – even on the fly via the mobile app.

– Because of the integration YNAB offers, you are able to see transactions quickly, and how it affects your budget. When you first start, you’re likely to have transactions that you didn’t recall when setting up your initial budget categories and amounts. It’s hard to remember everything; which is why I wanted to point it out in this YNAB review 2016. YNAB’s setup makes it nearly impossible to have regular monthly expenses that you forget about more than once. A transaction comes in, and you need to give it a category. If you’ve forgotten about that item, you simply add another category in your budget, input the appropriate amount, and the transaction is reconciled – taking you one step closer to having a truly balanced budget, with no dollars slipping through the cracks.

– If you don’t use all your money in a category one month, YNAB automatically moves the remaining balance into the next month. Budgeted $30 for clothing, but only spent $18? It will be there, waiting for you in the clothing budget next month.

– Have a reimbursement account for work-related expenses? You’re spending in this month, but getting the money back later – and this is a big  problem in most budgeting methods. YNAB’s app tackles this difficult budgeting issue and makes reconciling and tracking inconsistent or reimbursement funds make sense in real life, for real people who want to have a budget that actually works for their income situation.

problem in most budgeting methods. YNAB’s app tackles this difficult budgeting issue and makes reconciling and tracking inconsistent or reimbursement funds make sense in real life, for real people who want to have a budget that actually works for their income situation.

Setting goals, tracking savings accounts, and advancing toward financial freedom and security…

After you’ve set up your budget, situated your accounts, and reconciled any current transactions into the appropriate categories, it’s time to set some goals. After all, that’s the main purpose of budgeting. Yes, it’s important to not bounce payments, and of utmost importance to live within your means – but the true purpose of budgeting is to make provision for goals in life. Paying off student loans, saving for a better vehicle, sending your kids to college, taking a second honeymoon (or a first)… whatever your dream, YNAB has the set up to empower, encourage, and spur you on toward it.

– You’ll set goals and track your progress as you achieve them.

– You’ll watch savings grow – and debt shrink. Who doesn’t love that motivation?

– You’ll see, in real time, financial freedom and security become more and more of a reality as your money “ages”. This is the point of budgeting, right? To get ahead of expenses – and stop living paycheck to paycheck.

Moving money…

Along with moving money into the next month so you can actually get ahead of your bills, YNAB makes it easy to track money you’ve moved between bank accounts. Had an extra expense, so you moved a little out of savings to cover it? Just categorize that transaction in both accounts, and you have a record of the amount moved, and why, both in the “outflow” account, and the “inflow” account.

Perhaps one of YNAB’s best features is how easily you can reallocate money to another category if you need it. Taking the leftover clothing money example from above… a few clicks, and your remaining $12 categorized as clothing is now an extra pizza on a busy night. And your budget is still balanced. That’s flexibility while maintaining accountability. I like it.

I could go on and on about YNAB, but I’d rather have you try it for yourself. You’ll thank me later. With YNAB’s approach to budgeting, you can clearly see where your money is going, how to redirect in practical life, and the progress you’re making towards your personal life goals. And that, my friends, is a huge part of saving more, earning more, and living abundantly!