Click here toSet up your

FREE Personal Capital account

We’ve all heard the phrase “if it isn’t broke, then don’t fix it” before. That rarely is the advice people need in most cases:

- Why go to the doctor for annual check-ups if I feel just fine?

- Why visit the dentist to get my teeth cleaned if I brush them at home?

- Sure, my car is making a clunking noise but it doesn’t need to go to the mechanic because I change the oil sometimes.

We get our annual check-ups and routine exams because, quite frankly, all doctors, dentists, and auto-mechanics do their best , and the best results are obtained, through preventative care. Consider Personal Capital “preventative care” for your finances. A way for you to check-up on, nurse to health any ailments that weaken it, and build a healthy “immune system” to keep your financial life from getting knocked off its feet.

PersonalCapital.com gives you a dashboard to everything happening with your money – particularly as it relates to your future. This dashboard is available online – and via some extremely easy to use apps for tablets, and phones. The FREE Android and iPhone apps, in particular, are clean, easy to handle, and beautiful for a mobile platform. In the iOS app store, the Personal Capital app maintains close to a 5 star rating with around 4,500 total ratings.

PersonalCapital.com gives you a dashboard to everything happening with your money – particularly as it relates to your future. This dashboard is available online – and via some extremely easy to use apps for tablets, and phones. The FREE Android and iPhone apps, in particular, are clean, easy to handle, and beautiful for a mobile platform. In the iOS app store, the Personal Capital app maintains close to a 5 star rating with around 4,500 total ratings.

Over half a million users are tracking $100 billion of America’s balance sheet on Personal Capital’s free financial tools. The security is top-notch. See below.

Here’s another reason for visualizing everything and giving yourself a financial check up anytime you like: You are going to feel more confident about your future! Tracking activity was my A+ #1 secret to losing more than 60 pounds.  Studies show that tracking activity works for diet & exercise”¦ and for personal finances. It helps remove some of the emotion attached to spending. It also helps you visualize the goal and the impact of daily activity. This isn’t about restriction from the things you love to spend your money on. It’s about being conscious with our money choices.

Studies show that tracking activity works for diet & exercise”¦ and for personal finances. It helps remove some of the emotion attached to spending. It also helps you visualize the goal and the impact of daily activity. This isn’t about restriction from the things you love to spend your money on. It’s about being conscious with our money choices.

Just how much could you save? A recentUCLA Study links the Personal Capital app to a 15.7% increase in savings.

You heard that right. If you are like the average Personal Capital app user:

If you’ll justdownload and use the app, you are likely to see your own spending drop15.7%!

Grab a calculator and measure what this will mean to your budget.

I can’t promise you’ll find a big stack of hidden money. You’ll still need to make the choices. But,when you see everything in one screen and in your phone app, you may feel just as pleased. In terms of your future, with some small tweaks, you’re probably better off than you think!

Maybe you’re like my wife and I. If you’re married, you likely have discussions about money that can possibly get tenuous. Perhaps you feel like you aren’t earning much with your 401K contributions – or you aren’t sure if you’ll hit your goals of having enough money for retirement or your kids’ college fund.

With the right tools to track and report your progress, you’ll be able to see just how awesome you really are!

How?

You may be familiar with Mint.com. Mint.com is an online budgeting platform that helps to manage monthly expenses. Personal Capital is similar because it seamlessly provides a platform for you to see every single dime and penny you have. With Personal Capital you can see where your money is at each and every hour of every day with the added bonus of also being able to track all of your investments — a feature lacking in the platform provided by Mint.com. It’s this feature, monitoring your investments, that is going to help you build wealth and financial strength for your future.

That’s downright powerful stuff!

The best part of this whole platform: it’s free – which makes it a no brainer, in my opinion… and why I personally endorse it to all SavingsAngel fans over other paid options.

If you listen to my podcast and follow my blog, you’ll hear me refer to Personal Capital from time to time — because it truly is the best solution for where I want to help you go. Follow the steps to sign-up below and I’ll walk you right through what each section does and how it is going to help you create a healthier financial future.

Is it secure?

As a consumer advocate, I’m concerned about security. I drilled down and read the background of Personal Capital and just how seriously they take security. They employ multiple authentication levels, use military-grade encryption algorithms to secure their data center, and their CEO and CTO come from a security background. Although we’ve seen that nothing is completely failsafe, the bottom-line is that using a monitoring tool like Personal Capital will allow you to easily see what is going on in all your accounts in one place. Since you’re already transacting in the world, it’s best to easily stay on top of your financial life.

Each day, (if you choose) you will receive a daily email containing every transaction during the last 24 hours in all your accounts. This is a feature you can opt-in to and it will allow you to spot suspicious activity quickly and put the kibosh on it before it could get out of hand. I’m all about staying aware of all things going on in my family’s life – and from a practical standpoint, this feature is one of the features I like most. FYI: Personal Capital requires you to authorize your computer prior to logging on. Any device that you choose to access your account also requires authorization. Once you set up the free app, you will be prompted to either receive an email or phone call prior to being able to launch the app. Personal Capital requires a password and pin number to log in from the app.

Sign Up & Create an Account

Sign Up & Create an Account

In order to sign-up for a Personal Capital account, you simply use your email and create a password.

When you open a FREE account with Personal Capital you are automatically directed to link all the accounts you have with various banks and financial industry firms.

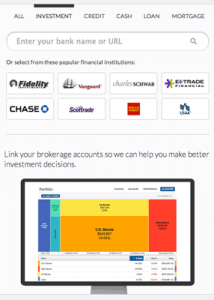

INVESTMENTS:

Do you have a retirement account with your employer? Or an IRA? Click on “investment” and link it up. Own some stocks? 401K? Annuities? Link them all up. If you don’t have these things yet, then you are still in the right place. No fear! Skip this step and link up your other accounts.

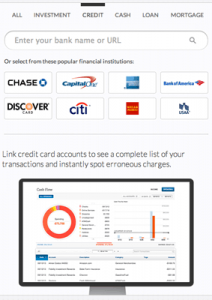

CREDIT:

CREDIT:

Do the same for all your credit cards. The average American household has about $15,000 in credit card debt. If you have credit card debt, don’t be embarrassed. Be empowered! Personal Capital will help you become so.

To help with earning and saving more, just keep plugging in to SavingsAngel.com and my podcast. I’ll empower you to pay your debts off faster by showing you the life hacks that will help you save and earn more. Personal Capital is the best tool I know that will allow you to see everything with clarity – a critical step to achieving success. The reason I personally love Personal Capital is that it works so well with those living a SavingsAngel lifestyle – or those who are fans of Dave Ramsey or other big name consumer experts.

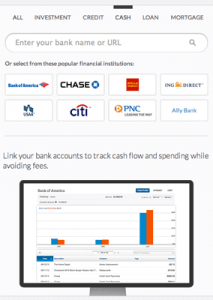

CASH:

This is your checking account. Link it up. In order to tell you where your money is going and help you see the big picture, Personal Capital will capture what goes in and out of your checking account. In order to build wealth and a healthy financial future, you need to start by maintaining good spending habits. Utilizing the tracking system with colorful visuals in Personal Capital can help deter you from spending on dinners out or other unnecessary and frivolous items so that you can continue to live the SavingsAngel lifestyle. Tracking spending is the number one way to effect change in your bank accounts which can help you “find” money to put towards investing! All because you signed up for free today!

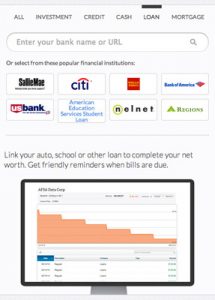

LOANS:

LOANS:

Link any unsecured loan, auto loans, or school loans here. By linking the other loans that you have in this section, you can see due dates to ensure that you never miss a payment, which can have a negative effect on your credit score – plus let’s face it… late-fees STINK! Having late payments can also prevent you from obtaining the best interest (or insurance) rates in the future should the need arise. Personal Capital will help you avoid this.

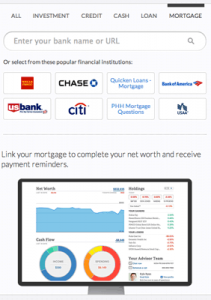

MORTGAGE:

MORTGAGE:

Lastly, link up your mortgage, to complete the financial picture. Personal Capital recently partnered with Zillow to help you get a greater understanding of the investment you’ve made in your home and its place in your financial future.

Traditionally, when one investment sector falls, others show gains. Though real estate has taken a hit, as every sector has, it has still been seen as a relatively low-risk investment that can help round-out an investment portfolio or group of investments, primarily because there is still a need for businesses to do business and families to live.

Tracking the value of your home can keep you apprised of changes in equity. If you hold many properties as part of a portfolio, this can affect your potential earnings on leases or rent. Perhaps you needed to hold a property until it hit a certain value in order to sell it. By utilizing this feature in Personal Capital, you can stay on top of the market so you’re ready to make that move when you can. Timing is everything!

That’s it! You’re all set up.

How to Use Your Account

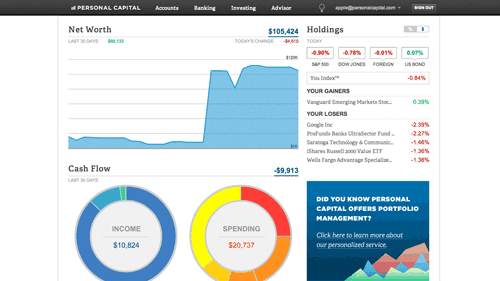

Once you are logged into your Personal Capital account you will see a Dashboard that tracks financial progress for 30 days. It graphs your Net worth (the total of all your assets less your liabilities), it displays your cash flow (illustrated with two colorful graphs that shows income vs. spending). It also summarizes your investment holdings. With their proprietary “You Index“, Personal Capital has harnessed the ability to see all your investments on one page.

Once you are logged into your Personal Capital account you will see a Dashboard that tracks financial progress for 30 days. It graphs your Net worth (the total of all your assets less your liabilities), it displays your cash flow (illustrated with two colorful graphs that shows income vs. spending). It also summarizes your investment holdings. With their proprietary “You Index“, Personal Capital has harnessed the ability to see all your investments on one page.

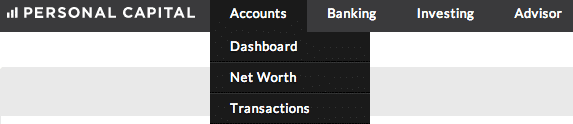

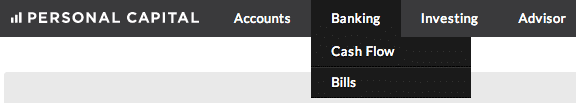

The toolbar

At the top of your Personal Capital Dashboard is your Personal Capital toolbar

Click on Accounts. The drop-down gives you choices to select: Net worth or Transactions.

Net worth will display a more detailed picture of the progress I’ve made over the month.

Transactions will simply be a log of all transactions over all accounts that are linked in Personal Capital. From that page, you can also toggle between cash, investment, credit, loan, and mortgage if you’d like.

Selecting “Banking“ on the toolbar allows you to see your Cash Flow. This is just what has come into and gone out of your checking account. There are some fantastic graphs that can really help you see how much you’re spending in one area. There is also another selection Bills that pulls up a very handy chart that shows your next due date, the account, last payment date, statement balance, minimum due, and the amount due. All in one place.

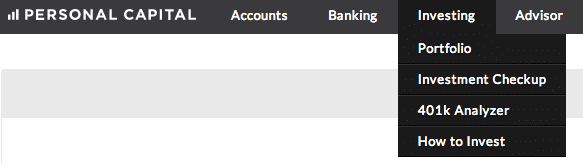

When you get to Investing, this is where Personal Capital sets itself apart from other applications. Under the dropdown “Portfolio“, your “You Index” is monitored and illustrated clearly to show you how the investments you’ve made are performing. Within this window, you can track their balances individually, their performance, and see your portfolio’s complete allocations… all at a really quick and easy glance.

This is a very important to tool to have because as the market changes daily, so does the balance of your investment portfolio. In order to make sure all your money isn’t invested too heavily in one area, but is spread around and diversified, checking up on it via a computer or, even better, the free app, can notify you when you need to make changes. If you have investments and don’t monitor them closely, you could be losing quite a bit of money that needs to be in your retirement account!

This is a very important to tool to have because as the market changes daily, so does the balance of your investment portfolio. In order to make sure all your money isn’t invested too heavily in one area, but is spread around and diversified, checking up on it via a computer or, even better, the free app, can notify you when you need to make changes. If you have investments and don’t monitor them closely, you could be losing quite a bit of money that needs to be in your retirement account!

Having such clear access to all your activity in one dashboard is pretty nifty when monitoring your investments is on the to-do list alongside getting to your daughter’s dance lessons and getting dinner on the table!

A second option under “Investing” is the ability to walk-through an “Investment Check-up.” It’s a free service that takes the information you’ve already plugged in, plus a few other details you input, and it ends with an ideal picture of how you should diversify your investments for the greatest growth over the period of time you’ve selected.

[box style=”simple” icon=”lightbulb”]

What is diversification?

1.) The variety of types of investments (stocks, both US and International bonds, mutual funds, and alternatives such as futures.

2) What percentage of your money is invested in each particular type.

[/box]

Your “Investment Check-up” should be viewed as an exercise regimen to help keep you on track for retirement. If you are new to investing (or you’ve just put your investments on autopilot previously), this is a fantastic tool to use.

The last free tool under the “Investing” drop-down is the “401k Analyzer“. By linking your 401k, you can see how it is being impacted by management fees. All 401k plans charge an administration fee. It is often a small percentage of the total overall contribution, sometimes carried by the employer, but frequently paid for by the employee. Personal Capital can illustrate to you what the management fees are in your 401k to help you plan accordingly for “lost dollars.”

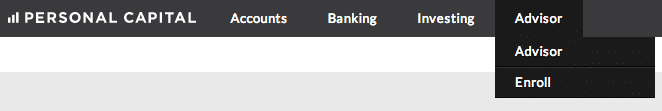

There are many features that folks can use to get a great start to growing wealth in a healthy portfolio, or collection of various investments. Once having achieved $25,000 in investable assets, members are given the option to utilize Personal Capital’s advisors for a fee starting at just under 1% which is extremely reasonable. You will get personalized advice based on your goals and assets which could increase your earnings. Think of this as an achievement reward for accumulating $25K in investable assets. Those who’ve I’ve chatted with who’ve utilized this feature have great things to say about the guidance.

When my wife and I are contemplating the many goals we have as a couple and as parents, we want to be certain that we’re doing the things we can to ensure our current and future financial security. With Personal Capital’s growing platform, we get to do that.

When my wife and I are contemplating the many goals we have as a couple and as parents, we want to be certain that we’re doing the things we can to ensure our current and future financial security. With Personal Capital’s growing platform, we get to do that.

We can also show our children, by example, how we are going about saving for the future. The kids are just as excited about the graphics as we are. You can never start too young when it comes to learning how to manage money!