SoFi review 2016 – Are they the ‘one weird trick’ to slash your student loan?

Many of my friends in the personal finance space have been buzzing about SoFi – a company that has been dominating headlines when it comes to a smarter ‘Silicon Valley’ way of dealing with student debt.

Who is SoFi?

This SoFi review 2016 is written nearly 5 years after SoFi started in 2011. And since then, by the estimation of many of my personal finance peers, SoFi has revolutionized the student loan, personal loan, mortgage, and mortgage refinance industry. Specializing in these three categories of loans, they work exclusively with college graduates. (You must have a degree from one of their over 2000 listed schools to qualify.) Their financing options are saving people thousands in interest and fees, versus traditional loans.

By working with college graduates, SoFi is able to use a nontraditional underwriting approach. They take into account that applicants have a college degree, have a solid work history (or a solid job offer starting within 90 days), and a strong repayment history of any loans to date.

The anti-FICO Dave Ramsey crowd ought to like this news:  Unlike most loans, SoFi no longer considers your FICO score when you apply for a student loan refinance. This is a recent change as of January 12, 2016 – and this SoFi review 2016 is important to point this out – because many recent graduates may not have enough credit history to have earned a credit score in the 700s – like many student loan refinance options may require.

Unlike most loans, SoFi no longer considers your FICO score when you apply for a student loan refinance. This is a recent change as of January 12, 2016 – and this SoFi review 2016 is important to point this out – because many recent graduates may not have enough credit history to have earned a credit score in the 700s – like many student loan refinance options may require.

Underwritten by investors that wish to create a positive social impact, SoFi derives its name from its mission. Social Financing – SoFi. When they first began, they relied on elite university alumni investors to fund refinances of student loans, then the company grew from there. Now they have loaned over $6 billion and counting. And due to their unique approach to underwriting, they are able to offer funding solutions (products) that aren’t available elsewhere.

How is SoFi different?

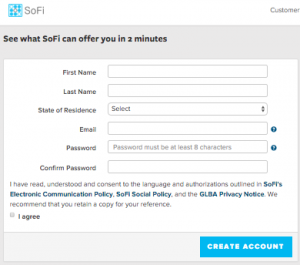

In this SoFi review 2016, we’ll look at what makes SoFi different and better. The largest difference (other than working exclusively with graduates at this time), is their easy-to-use electronic application and underwriting process. I’ve done the old method.  What a pain! Unlike traditional loans where you need to meet with someone face to face (or over the phone), then send copies of numerous documents, and even pay to pull a credit check. Despite your FICO score no longer being a factor, if you decide to move forward after a 3-minute pre-qualification application, the credit history is pulled to show that you have a good track record of meeting financial obligations. The other two factors SoFi uses to determine eligibility and student loan refinance loan rate are employment history and monthly cash flow minus expenses.

What a pain! Unlike traditional loans where you need to meet with someone face to face (or over the phone), then send copies of numerous documents, and even pay to pull a credit check. Despite your FICO score no longer being a factor, if you decide to move forward after a 3-minute pre-qualification application, the credit history is pulled to show that you have a good track record of meeting financial obligations. The other two factors SoFi uses to determine eligibility and student loan refinance loan rate are employment history and monthly cash flow minus expenses.

SoFi uses electronic transmission of necessary documents. This customer experience matches their ‘Silicon Valley’ culture. They even accept computer screen shots, and pictures taken with a phone, eliminating the old school necessity of scanning and sending (or even faxing) documents. Their online application interface can tell you in 15 minutes or less whether or not you qualify and, if you do, what options you have.

Perhaps one of the best features is being able to see loan options you personally qualify for, versus the often slow, and sometimes cumbersome, method of having a traditional lending agent run various scenarios. (In  particular, this is helpful when refinancing a mortgage, as you can see the changes in real time if you play with the loan duration and/or the down payment amount.)

particular, this is helpful when refinancing a mortgage, as you can see the changes in real time if you play with the loan duration and/or the down payment amount.)

Another benefit of SoFi’s unique application process is that they use a “soft pull” for credit checks. That means that you can apply with them, to see if you even have options, without hurting your credit score.

As if all this isn’t enough, SoFi goes even THREE steps further than a normal lending institution. First, they offer career placement services;

As if all this isn’t enough, SoFi goes even THREE steps further than a normal lending institution. First, they offer career placement services;

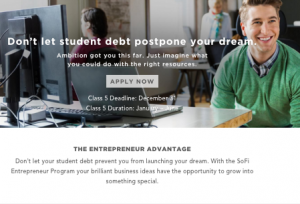

Second, they offer an entrepreneur program to help graduates start a business while handling their student loans; and…

Third, they offer unemployment protection at no charge. That means that if you have a loan with them, and lose your job through no fault of your own (in other words, you don’t do things like just quit or get  fired for breaking company policies), they suspend your required payments for a specified amount of time. Interest continues to accrue during that time period, but you have the financial relief of not needing to make any payments. The duration of this free protection varies by loan type and situation.

fired for breaking company policies), they suspend your required payments for a specified amount of time. Interest continues to accrue during that time period, but you have the financial relief of not needing to make any payments. The duration of this free protection varies by loan type and situation.

On top of all these advantages, SoFi has no fees, no prepayment penalties, and low interest rates.

So… How much can you save with SoFi?

Of course, rates will vary depending on the type of loan and specifics of the amount borrowed, loan duration, individual merit, and, of course, what are the current rates when you start a new loan. But in general, SoFi offers some of the lowest rates – if not THE lowest rates – available.

Some general examples found when this SoFi review 2016 was written:

Student loan refinance rates range between 2.13% – 7.24% – depending upon whether you choose a fixed or a variable rate, what your consideration factors allow, and whether or not you enact auto-pay which will save you an additional .5%.

With any loan option, staying financially conservative, I generally recommend going with a fixed rate, unless you are positive you could pay off a variable within the necessary time frame – and that time frame is within a few years. Otherwise, the risk might not be worth the lower interest variable rate – which could change at any time. Calculate the difference and consider the risk before choosing.

Based on a number of chats with other financial experts and chats with SoFi customers, my advice is to compare what you can get through SoFi to what you currently have. You’ll get an idea of your savings with your 3-minute pre-approval application. Take a few minutes and check. SoFi will only do a soft-pull of your credit.

If your student loan is substantial (more than $20K), you are likely to save thousands of dollars. SoFi does have a minimum loan amount of $10K – so if your balance is less than $10K, stay put.

Also a consideration: If your student loans are currently with a government program, be aware that you’ll be giving up any federal protections (See also #2 here). In most cases, if you can save thousands, it should be worth it to forego the federal benefits in favor of SoFi’s added benefits.

Rates vary all the time, so your savings may be even better than the ones mentioned in this SoFi review 2016. And although savings will vary depending upon your personal situation – being able to refinance, and even consolidate multiple loans into one, with a lower rate and a single payment, is financially smart – and definitely a part of living abundantly!

A favor please?

If you found that our SoFi review 2016 was helpful, please use my link to find your SoFi rate. My dear friend, Rachel, and I worked together to gather these notes (and advice) for you. Unlike if you were to just do a Google search for SoFi review 2016, I will take any commissions and put 100% of the proceeds into creating our podcast, blog, free coupon database, and all the other free resources we make available to our audiences. I am very grateful for your support – and would love your suggestions on other products and services we should review.