Free Credit Score and History better than Annual Report. Quizzle.com review and walkthrough.

Click HERE to get your truly free credit report

You likely hear a lot today about credit scores and credit reports and whether or not you know what your personal credit rating is.

You may have heard the advice that you don’t need to worry about your credit score if you have no intention of getting a loan. With my consumer advocate hat on, let me be very direct with you. This is foolish advice.

You need to be on top of your credit rating and everything in your report. If you’ve lived like many who keep their head buried in the sand because they don’t want to see mistakes from the past, this is simply bad life management.

It’s time to move forward, get on top of everything, and get some good advice on the steps necessary to grow.

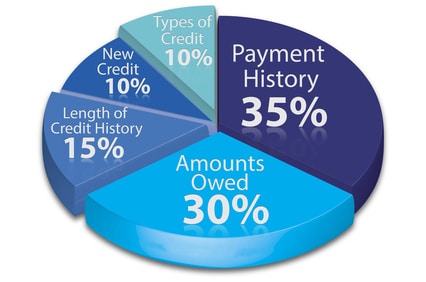

Your credit score and history can reveal fraud, identity theft, and either save you money or cost you dearly.

How? By paying more than others for a car loan, car insurance, rent, a mortgage, and every other loan you may have. Risk, and the ability to pay, are key factors in any of these situations.If you have a low credit score, lenders are likely to place extra requirements on your loan, including a cosigner, a large down payment, a loan that has a shorter maturation period, or a higher interest rate.

Both property management companies and individual landlords look for security when renting out their properties. They rely on credit scores and credit reports to protect themselves against deadbeats.

To an auto insurer, credit information is very predictive of future accidents or insurance claims. This is why most insurers use this information to help develop what they consider more accurate rates. The better your credit, the higher your chances of securing the best rates.

Likewise with car loans. In November of last year, Cars Direct gave this breakdown of typical interest rates you could expect with different credit scores:

- 850 – 740:Excellent credit score – 3.2% interest rate (on average)

- 739 – 680:Average credit score – 4.5% interest rate (on average)

- 680 and below: Sub-Prime credit score – 6.5 – 12.9% interest rate (on average)

Bad credit can also hinder you in getting a job.

Forty-seven percent of employers check applicants’ credit history as an indicator of their employability, according to a 2012 survey by the Society for Human Resource Management.

Some jobs even require a credit check by law. State laws vary, but most include positions as teachers, police officers, firefighters, and day care providers, just to name a few. Customarily, credit checks are standard for any position that involves finances and/or the handling of money. This covers a wide range of job positions in the work force. Because an individual with bad credit may appear to be irresponsible, untrustworthy, or undependable, it can mean the difference between hiring you or someone else.

In addition to helping you get better financial rates and secure a job, monitoring your credit regularly, especially to watch for negative changes, helps you stay on top of your finances. And it can be the first line of defense in discovering identity theft. Attacks on credit have become an everyday event. Scammers can take your information from one card and use that to apply for new credit in your name. Thousands of dollars can be racked up in a short amount of time without your knowledge that an account even exists. Through regular monitoring of your credit report, you can easily spot any accounts that may have been opened in your name that you did not initiate. Protect yourself against identity theft using these 8 tips from one of my recent articles.

Here are a few more reasons to monitor your credit:

- A review of your credit report will reveal any hindrances you may have to receive more credit or new credit. There could be errors on your report that need to be corrected.

- It’s an important tool in assessing your financial health and well-being. Tracking your spending, and setting aside savings, are essential to becoming financially successful.

- If you are recovering from past credit problems, your credit report and credit score will reveal your progress.

- It’s free! Continue reading and I’ll tell you exactly how to do that.

How to get a Truly Free Credit Score and Credit Report

The big 3 (Transunion, Experian, and Equifax) and other highly advertised services all promise a “free” credit score. You’ll soon find that you’ll likely be badgered to death to buy their paid credit monitoring service. I go through this every January. The process is cumbersome and tricky if you don’t get the secret questions right. This past year I missed out on one of them because I got a question wrong.

In some cases, paid monitoring services (and your billing information) is mandatory to even see your score. A credit score from Quizzle.com, on the other hand, is completely FREE, with no strings attached. Your credit score and history will also be updated every six months for you – at no charge.You aren’t required to give them your credit card number, but you do need to enter other personal information beyond your name and address, including your social security number. This is simply a requirement to ensure that only you are seeing your sensitive information – and not a thief.

Quizzle.com is a Detroit, Michigan-based company (which I love) and is a part of Quicken Loans. I met them recently at FinCon14 where I was a guest speaker to personal finance bloggers. I spoke with them and expressed the skepticism that some people feel about credit – that supposedly monitoring your credit score and history is only for people who intend on taking on debt. As mentioned above, I heartily disagree with this. The Quizzle folks I chatted with agreed that bad debt is… well… bad; and a stellar credit history and score is the goal and Quizzle is a great tool to help you get and stay debt free.

The credit score you receive from Quizzle is a VantageScore® credit score. The VantageScore is a scoring formula that was created by Transunion, Experian, and Equifax. If you were to check your FICO score against the VantageScore from Quizzle, you’re likely to find that they are very similar – but not guaranteed to be the same.

Even though the FICO score is the gold standard for lending/credit decisions, there are many different credit scoring models with different algorithms used by reporting agencies and lenders. Most lending decisions go beyond just a credit score. VantageScore is gaining in popularity and is a good enough metric for most consumers to rely on.

More important than your credit score is your credit report. As mentioned earlier, this is where you can pinpoint identity theft and/or account errors that need to be corrected.

Quizzle’s credit report is powered by Equifax. Your report will show any and all open and/or closed credit card accounts, loans, and mortgages. It gives you a detailed description of each account in an uncomplicated, easy to read format.

I just completed the process for myself before writing this review and walkthrough. It took me about 5 1/2 minutes to complete the sign-up process – including confirming my email address.

I just completed the process for myself before writing this review and walkthrough. It took me about 5 1/2 minutes to complete the sign-up process – including confirming my email address.

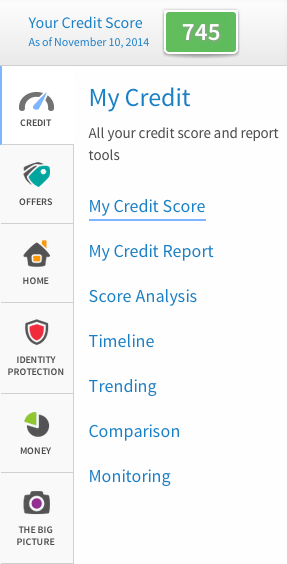

As soon as you sign up and fill in your information with Quizzle, it will generate your credit score and credit reports. Then every time you sign in, MY QUIZZLE is the snapshot landing page that you’ll see.

From here you can navigate to MY CREDIT, MY OFFERS, MY HOME, MY MONEY, and THE BIG PICTURE.

My Credit

gives you your credit score and report tools.

This is the report at-a-glance, or snapshot, of your credit history; including loan and credit card information, and the status of each account. I’ve pulled my free credit history in the past from the big three. The free reports are horrendous to navigate and complicated if you’d like to easily find trouble spots. As you can see in my screenshots, the interface with Quizzle is very attractive and easy to use.

Under the My Credit section,

Your Score Analysis

Will help you determine what could be holding you back from having the perfect credit score of 850. I find this advice to be the most helpful feature of Quizzle: personalized strategies for getting your score higher.

If you want to save money across the areas I shared earlier, simply take the steps outlined by Quizzle.

Your score should improve faster than if you had taken no action. Also – if you think that taking out new lines of credit is the only way to improve your score, you’re mistaken. I have no intentions of taking on new debt – and Quizzle offered me three custom-tailored strategies that fell outside this.

The Timeline

section shows you a unique perspective of your credit history and outlines major positive and negative credit milestones. Again, another very clear view of what’s happened in your past – and what you have to build upon moving forward.

My Offers

provides you with all the ways your credit score can save you money.Here you’ll find what you personally qualify for in order to help save you money. Refinancing possibilities, new mortgages, credit card perks you may not know about, auto insurance comparisons, and more. These offers are all optional – and obviously are a part of how Quizzle can afford to provide their other services at no cost. The advantage of keeping the offers within the Quizzle system is that offers are tailored to what you may qualify for – so you aren’t wasting your time on ones that won’t help you meet your objectives.

My wife and I had been attempting to refinance our mortgage with our current bank since we’re able to lower our interest rate and payments – but as business owners, some banks treat us like we’re from Mars (including our current bank). We’re currently going through the process with Quicken Loans (parent company of Quizzle). It’s a completely different experience. More on this another time!

My Home

Offers some facts about your home, mortgage, and neighborhood that you may not already be aware of.This includes a home value estimate, mortgage recommendations, neighborhood demographics, housing averages, and homes sold in your area, just to name a few.

If you’re looking to get the low-down on your neighborhood without actually talking to the people living around you, the Neighborhood Comparison is your new best friend. It reveals all the interesting stats in your area including average age, income, and education of your neighbors, and the overall crime risk where you live.Not everything in your neighborhood can be seen from the outside. Something in these statistics may be an indicator that it’s time to move to a new area.

Maybe you’re already thinking about a move. In order to make a wise financial decision, you want to know the value of your home and the mortgage options available to you.

My Money

Provides you with your debt, income, and financial management tools.Quizzle will help you evaluate your financial responsibilities through budget recommendations and planning a rainy day fund. Your debt-to-income ratio (DTI) is provided to help you determine where you can make financial improvements.

You can have a high income, but it is your DTI that determines whether or not you can afford to repay any new loan. Lenders consider applicants with a high debt to income ratio a greater risk. Each lender has their own DTI limit when considering loan applications for approval.

As a general rule, a mortgage lender will want your income to be 55% greater than your outgoing mortgage payment, plus other liabilities such as student loan or credit card payments. If this isn’t what you see in your DTI, then you need to take the appropriate steps to lower your debt obligations if you want to take on a mortgage.

The Big Picture

The Big Picture

Covers, well, the big picture when it comes to your finances.If you’re looking to buy a home or considering refinancing, you’ll be able to see what your chances are to be approved for a mortgage without more credit inquiries. The Quizzle chart shows you exactly where your credit score needs to be in order to qualify for the best rates.

So how does Quizzle make their money if they give away this information?

Quizzle offers several fee-based services such as refinancing your home – or establishing another line of credit to pay debts, etc… These charges are never automatic and are all advertised clearly as being something you pay for. As a consumer advocate, I love that Quizzle is very upfront about offers and there aren’t any tricky hoops that you need to jump through like other methods of getting a free credit score. The offers are relevant and shared appropriately. I’ve gotten an email from them every few days – and find they are balanced with value and offers.

Also, Quizzle has two premium plans that might be worth your investment:

Quizzle Pro

($8 monthly) updates your credit score and report each month – as opposed to every six months (free) and also gives you 24/7 credit monitoring.You’ll receive an alert if you ever receive a past due payments on your credit, establish a new card or loan accounts, and if there are any credit inquiries added.

Quizzle Pro may also be valuable for you if you are interested in refinancing and you need to improve your score. This could be a time and money saver if you are waiting to hit a new higher score and would like this information updated regularly to signal when you should take action. Monthly monitoring will also help you better stay on top of additions or changes to your credit history.

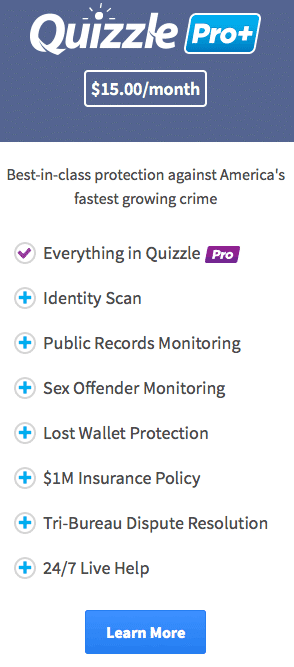

Quizzle Pro+

Quizzle Pro+

($15 monthly) is the gold standard for staying on top of your credit and security.

(Disclosure: Quizzle kindly extended a complimentary Pro+ account for my review).

Pro+ is where things get a little robust – and quite frankly, I’ve never seen anything quite this comprehensive. For an additional $7 monthly, you get everything from Quizzle Pro (above) and you also get some pretty powerful features to monitor what’s going on in your life.

Identity Scan

Watches thousands of websites in search of your personal information including your Social Security number, bank account, and debit and credit card numbers. If they find that your information is being bought or sold online, Quizzle will alert you and help you restore your identity quickly.

I don’t know of any other service that does this – even though security breaches are regularly mentioned in the news where there is fear that millions of people may have had their personal information posted on some hacker website.

Public Records Monitoring

Keeps an eye on Court and Criminal Records, SSN Trace, Payday Loans, and United States Postal Service (USPS) Change of Address monitoring. These all could be evidence of Identity theft that you would likely not learn until much later in the process.

Sex Offender Monitoring

Monitor registered sex offenders in your area and know if a sex offender fraudulently registers in your name. As a parent of three kids, I would gladly pay a couple dollars a month just to know this information. It’s included in Pro+.

Lost Wallet Protection

I’d really hate to lose my wallet. This benefit helps you with canceling and replacing all your lost or stolen wallet items.

$1M Insurance Policy

If you become a victim of identity theft, you can receive up to $1M for costs related to restoring your identity. I’ve heard the horror stories and I’ve personally purchased identity theft protection on my own at $10/mo. for over eight years.

Tri-Bureau Dispute Resolution

There are services that will charge you sums of money to dispute errors with the three major credit reporting bureaus. Pro+ includes it as part of the $15 rate.

Would I pay $8/mo for Pro or $15/mo. for Pro+?

I consider this both a service and an insurance of sorts. The service is good for my wallet. The insurance is good for my livelihood… and my family.

I consider this both a service and an insurance of sorts. The service is good for my wallet. The insurance is good for my livelihood… and my family.

I’ve already been paying $12.95 a month for basic identity theft protection plan for the past eight years. It includes the same monitoring as the regular Quizzle Pro account ($8/mo.) and provides for restoration should I have my identity stolen. Lifelock, by comparison, is (much) more expensive for a similar plan ($30/mo).

With the Quizzle $8 plan, I get the same monitoring – but I now get to see my credit history (and score) updated monthly.

For the additional $7, I get all the additional monitoring and can cancel my previous $12.95/mo. ID theft plan. The Quizzle interface is much easier to use than what I’ve used – and I now get several new areas of monitoring that I never had previously.

For my situation? The $2.05/mo. difference (to get the $15 Quizzle Pro+ plan) is a no-brainer. However, I wouldn’t worry about all this now if I were you. For now, get your free Quizzle account set up and decide for yourself.